The article on what is a financial market? will introduce you in more detail to the options and tools for investing and making more money in your daily living life. Before understanding the financial market, firstly, you should know what the is market. and type of investment in the financial market.

What is a Market?

The word “market” derives from the Latin word “Marcatus” It means merchandise, it’s the place where goods are available for sale, exchange, and trade or the place for running a business. The general definition of the word market means it’s the place where goods are transported and sold.

Markets include places and areas where buyers and sellers are competing freely. The term market does not refer to a place, but to commodities and buyers and sellers who compete directly with each other.

A marketplace is a place where two parties can gather or meet to facilitate the exchange of goods and services. The parties involved are usually the Buyer and the Seller. Marketing can be like a retail outlet that people meet in person or a virtual market such as an e-commerce store that has no direct relationship between buyers and sellers.

Technically speaking, a market is a place where two or more parties can meet to conduct economic transactions – even goods that have nothing to do with legitimacy are considered a place to trade. Market transactions may involve goods, services, information, currencies, or one or more of the above transactions passing from one party to another.

In an economic system, there are many interconnected markets. For example, the market for cars depends on the market for raw materials such as steel, rubber, and glass, electronics, as well as related to the labor market, because people need to design and assemble cars. What is happening in a market can have an “impact” on the surrounding market. If the price of steel goes up, it will push up the price of cars as well. On the other hand, if oil prices rise, demand for cars will fall, thus reducing the demand for steel by automakers.

Type of Markets?

Currently, we are dividing markets into the following three categories:

- Products Market

- Factor Market and

- Financial Market

Below are more details of each type of market.

1. Product Market

The product market is where goods or products or commodities are exchanged. The market includes buyers and sellers and has the equipment to communicate with each other for the transaction of goods.

For example, in the Kingdom of Cambodia, there are many product markets such as Central Market, Orussey Market, Olympic Market, Dermkor Market, Samaki Market, and Chbar Ampov Market. Kandal Market, Phsar Chas Market, Phsar Leu Market in Sihanoukville, Siem Reap Province and Battambang Province, Beungkok Market in Kampong Cham Province, etc. These product markets sell all kinds of goods from vegetables, fruits, grains, and clothes to jewelry.

Shopping malls such as AEON Mall, Olympia Mall, Sorya Shopping Center, Sovanna Shopping Center, Boeung Trabek Plaza, etc. There are all kinds of goods for sale, but the standard is higher than the general vegetable market, and most of the clothes are expensive and branded clothes.

Product Market classifies due to different approaches. In the marketing system, there are 10 different ways to divide the markets, such as:

- Numbers of Commodity

- Area of Coverage

- Location

- Time Spend

- Volume of business

- Nature of transactions

- Degree of competition

- Government Interventions/Regulations

- Nature of commodities

- Visibility or vision

General and Specialized Markets

General and Specialize Markets are below

The General Market is where all kinds of goods are sold. Goods range from cereals, seasoning, food, and textiles.

Specialize Market deals with specific commodities. Markets are named after the types of commodities transactions or traded. For example, a market that sells goods such as vegetables, wool, grasshoppers, etc., is named a vegetable market, a woolen market, or a grasshopper, depending on the type of goods on which it is traded.

2. Factor Market

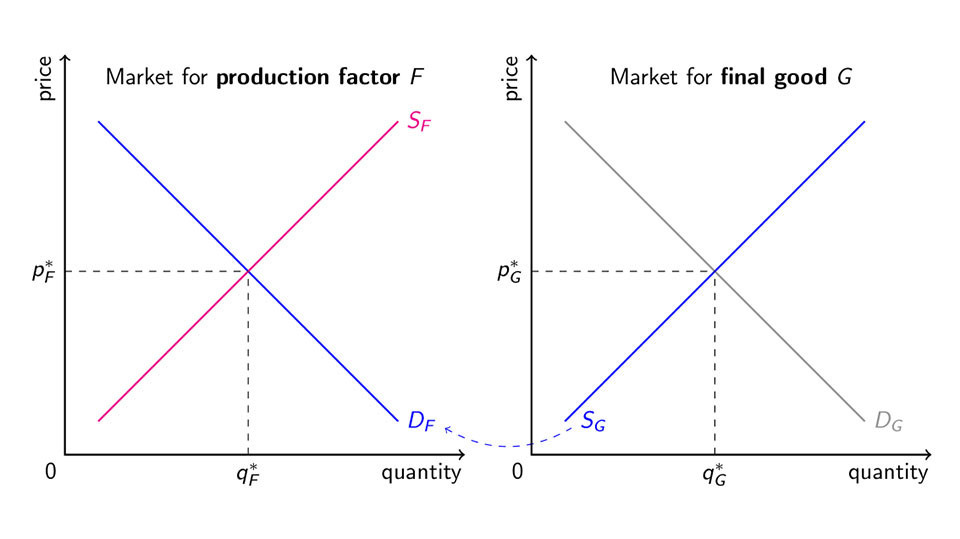

Factor Market, also known as the Resource Market, is a market for providing and receiving inputs needed for production. Producers are usually the sellers in the market for a product (see graph below), but they are the buyers in the market for their Factor Market.

Resources are defined as resources that must be used in a production process to produce goods or services. That is why these resources are factors of production.

The main factors of production are labor, capital, land, and entrepreneurship.

The first three factors of production, namely labor, capital, and land, trade as in the Factor Market, which determines the equilibrium quantity and value of those factors. The fourth, in factor of production is entrepreneurship as the founder of a company or business and renting other factors of production. Most Factor Markets are competitive, i.e. there are many buyers and sellers.

Labor Market in the factor market include human resources being traded. Most of the labors trade through the formation of contracts called jobs. Some workers are traded or hired on a daily or part-time basis, called casual labor. Human capital is an individual skill acquired through education, experience and training. The value of labor is the wage rate.

The capital market is the funds that companies used to buy and run their production processes. In this market, people lend and seek loans to finance the purchase of capital goods. The value of capital is the interest rate.

Land Market – Land refers to all the resources that nature gives us. It includes natural gas, water, minerals, and so on.

The dependence on the product markets and factors markets sometimes gives good reason for the producers and suppliers to be integrated into the supply chain, which is vertical integration.

As a result, the sales contract replaces a free employment contract and internal operations between departments. While such ownership changes can help producers manage risk and increase efficiency, they tend to reduce competition, which can lead to market failures and problems of mistrust. Based on definition, by analyzing the ceteris paribus theory show that some part is not sufficient to understand the effects of a change in equilibrium in a factor market on the equilibrium in related markets. A generally balanced approach that includes impacts and changes in multiple markets is required.

3.Financial Market

The last type of markets is financial market, when we talk about the financial market refers to the place where people can buy and sell or we can say “Exchange” the financial assets such as stocks, bond, derivatives, commodities, and foreign exchange.

The financial market is the place where facilitates the financial transactions or financial assets trade in term of investment in the business transactions.

Financial market help the firm or deficit to collect the capital or fund for supporting their business operation by selling the variety of financial assets such as bonds or stocks etc. And it’s also the key location to promote the investors, households or surplus use their money to invest in the financial market by purchase the financial assets and get the benefit from their investment based on the term and condition of the products that they are invested.

Thus financial market is a forum between the seller or deficit side and the buyer or surplus side met and exchanged the financial assets in the purpose of earn more money or make more investment in the economic system.

Type of Financial Markets

There are four main different types of financial markets such as below:

- Stock Market

In stock market provides opportunities for corporations or business entities to collect capital from the public by issuing shares to investors or households and gives a chance to investors make more money by purchasing the stock of the company that is listed on the stock exchange.

The business entities or corporations will share the profit from the operation with the investors who are holding their shares or shareholders.

- Bond Market

The bond market provides opportunities to cooperate in gathering capital by selling their bond at a fixed rate to investors and investors can take these opportunities to buy the bond for fixed interest.

- Commodities Market

Besides stock and bonds, you can invest in commodities such as gold, crude oil, wheat, corn, etc. If you are investing with commodities because you expected that the movement of commodities price will make you make more profit.

- Derivative Market

For derivative market investment, when you purchase or make an investment you do not get any physical assets on your hand, it’s just the right or obligation of holding the investment of the underlying assets. The benefit is from the price movement or price change.

Read more articles here

- What Is Financial Instruments?

- Video on What is the financial market?

- When Was IMF Formed?

- How to Buy Online Product, Chinese Product Sourcing

Purchase online products

For purchasing online products from the Amazon store please click the banner below.

There are many products at the Amazon store including clothes, electronics, fashions for babies, girls, boys, men and women, health care items, home and household products, industrial and scientific products, etc.

We are very appreciative of your support in buying the products in the Amazon stores through my link banner below because when you buy we will get some commissions from the Amazon affiliate program.

Learn how to make money online

If you want to learn how to make money online (MMO) with the trust website, please click the banner below.

You can learn more about digital marketing and how to make money online. It’s the skill that fits the current era. We recommend it because we have experience with this platform for more than 2 (two) years with the Wealthy Affiliate (WA) Program. Please do not hesitate to contact me to clarify this program and how to make a deal with Wealthy Affiliate (WA). Or you can directly click the above banner.

Thanks for reading this article, if you have any questions, doubts, or discussions please drop your comments in the comment box.

Hi Sean – Reading through this article brought me back to some business classes I had back in college. I never thought I would have to look at another supply and demand chart haha. You share some great, introductory material that is good for anyone to know, especially with how globalized the world economy has become. In your opinion, what’s your stance on investing in derivatives? To me they seem too risky but I know they can also be complicated.

Hi Dereck,

Great to hear you and thanks your comments about the financial market especially derivative market. Derivative is very risky instrument in the financial tool or investment. Investing in derivative market you need to learn about the basic knowledge, set the trading plan, and discipline to follow the trading plan. 95% of traders in derivative market are fail because of lacking discipline.

Good article

I am into financial markets and I can say that it is a good place to be in if you have to right knowledge and I think for me it is the best market for people who want to secure their future. However people need to know the risks that it comes with.

Yes, financial market is a good place for investing, there are many options and instrument for making money, but before jumping into this market we recommend you should learn about the basic of knowledge and how to control the risk and manage the portfolio.

Great article!

When most people think about the stock market, they think about buying and selling shares of ownership in a company. But there is another type of market, which you mentioned, that is just as important to the overall health of the economy: the bond market. In the bond market, investors buy and sell debt instruments, such as government bonds, corporate bonds, and municipal bonds.

Bonds are a key part of the financial system because they provide a way for companies and governments to borrow money. When a company needs to borrow money for a new project, it can issue bonds to investors. The company agrees to pay back the loan with interest over a set period of time. Investors who buy these bonds are taking on the risk that the company will not be able to repay its debt.

Governments also use bonds to finance their operations. When a government issues a bond, it is borrowing money from investors. The government promises to repay the money plus interest over a certain period of time. The interest rate on a bond is determined by the risk that the government will not be able to repay the debt. Bonds are considered to be low-risk investments, so they usually have a low interest rate.

Yes, bond is the most safe investment in financial market, stock market is higher risk than bond, and the rest are based on the type of investment. High risk and high return.

Thanks for helping break down the different financial markets and what it all means. Being able to invest in them can be a great source of income, but you need to understand the basics first to get the right direction to take.

Understanding the supply and demand in a specific market is the key to being successful.

That’s right John, if people want to invest with financial instruments, they should to learn the basic knowledge and understand the key for success of each product. Please find the professional advisors to help this investment.