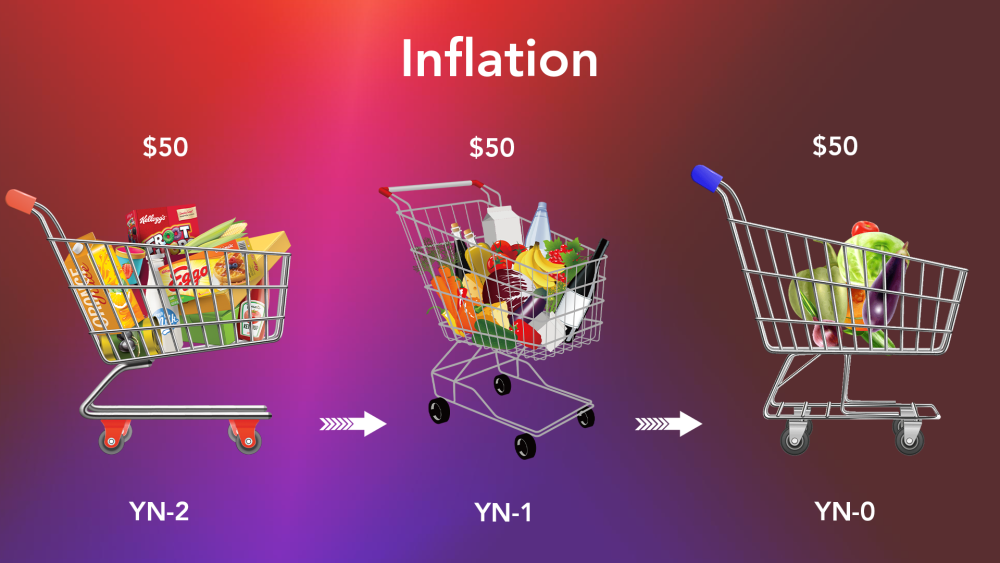

When we talk about inflation we talk about the virus of the economy. It refers to the rate at which the general level of prices for goods and services in an economy is rising over a specified period, typically measured on an annual basis. It reflects a decrease in the purchasing power of money, meaning that each unit of currency buys fewer goods and services than it did before.

What Does Inflation Increase Mean?

When the inflation rate increases, it means that the rate at which prices for goods and services are rising within an economy has accelerated compared to a previous period. In other words, the percentage increase in the general level of prices has risen.

Here’s what an increase in the inflation rate implies:

- Rising Prices: Consumers will typically experience higher prices for goods and services they purchase regularly. This can lead to a decrease in purchasing power as each unit of currency buys fewer goods and services.

- Cost of Living: An increase in the inflation rate often means a higher cost of living. People may need to spend more money to maintain their standard of living, especially if their incomes do not rise at the same pace as prices.

- Impact on Savings and Investments: Inflation erodes the real value of savings and fixed-income investments over time. For example, if the inflation rate exceeds the interest rate earned on savings accounts or bonds, the purchasing power of those savings decreases.

- Uncertainty: High or rapidly increasing inflation rates can create uncertainty in the economy. Businesses may struggle to predict future costs, leading to cautious investment and hiring decisions. Consumers may delay purchases in anticipation of even higher prices in the future.

- Policy Responses: Central banks and policymakers often respond to increasing inflation rates by adjusting monetary or fiscal policies. For example, central banks may raise interest rates to cool down spending and borrowing, which can help reduce inflationary pressures.

An increase in the inflation rate signifies a faster pace of rising prices in the economy, which can have various implications for consumers, businesses, and policymakers. Individuals and organizations need to monitor inflation trends and adjust their financial plans and strategies accordingly.

What Factors Are Influenced by Inflation?

Inflation is influenced by various factors, including:

- Demand and Supply: When demand for goods and services exceeds supply, prices tend to rise, leading to inflation. Conversely, when supply outstrips demand, prices may fall, resulting in deflation.

- Cost-push Factors: Increases in production costs, such as wages, raw materials, or energy prices, can lead to higher prices for goods and services, contributing to inflation.

- Monetary Policy: Central banks influence inflation through monetary policy tools such as interest rates and money supply. Lowering interest rates or increasing the money supply can stimulate spending and borrowing, potentially leading to inflation. Conversely, raising interest rates or reducing the money supply can help control inflation.

- Fiscal Policy: Government spending and taxation policies can also impact inflation. Expansionary fiscal policies, such as increased government spending or tax cuts, can stimulate demand and potentially lead to inflation.

- Exchange Rates: Changes in exchange rates can affect the prices of imported goods and services. A depreciation of the domestic currency may lead to higher import prices, contributing to inflation.

Inflation is commonly measured using various price indices, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). These indices track the changes in prices of a basket of goods and services over time.

PROs and CONs Of Inflation

Below are the Pros and Cons of Inflation for the economy, It’s good or bad depending on the government’s economic health and system.

PROs Of Inflation

- Encourages Spending: Moderate inflation can encourage consumers to spend and invest rather than hoard money. When people expect prices to rise, they may be more inclined to make purchases now rather than later, stimulating economic activity.

- Debt Relief: Inflation can erode the real value of debt over time. Borrowers who hold fixed-rate loans benefit from inflation because they repay their debts with less valuable currency. This can provide relief to individuals and businesses burdened by debt.

- Fosters Economic Growth: Inflation, when moderate, can be indicative of a growing economy. It often accompanies periods of increased demand, production, and employment. Central banks may target a moderate inflation rate as a sign of a healthy economy.

- Provides Price Signals: Inflation can act as a signal to businesses to increase production and investment. Rising prices may indicate increased demand for goods and services, prompting firms to expand operations to meet consumer needs.

CONs Of Inflation

- Reduces Purchasing Power: Inflation erodes the purchasing power of money, meaning that each unit of currency buys fewer goods and services over time. This can lead to a decrease in the standard of living, especially for those on fixed incomes or with limited savings.

- Uncertainty and Planning Challenges: High or unpredictable inflation rates can create uncertainty for businesses and consumers. Companies may struggle to forecast costs and revenues, leading to cautious investment and hiring decisions. Individuals may find it difficult to plan for the future, causing financial stress.

- Income Redistribution: Inflation can redistribute income and wealth within society. Creditors and savers lose purchasing power as the real value of their assets decreases. Borrowers, particularly those with fixed-rate loans, benefit from inflation as they repay debts with less valuable currency.

- Distorts Economic Decision-Making: High or volatile inflation can distort economic decision-making. It may encourage speculative behavior, discourage long-term investments, and distort price signals, leading to inefficiencies in resource allocation.

- Fixed Incomes and Savings: Inflation can disproportionately affect individuals on fixed incomes, such as retirees, and those with savings in cash or low-interest accounts. Their purchasing power declines as prices rise, potentially jeopardizing their financial security.

CONCLUSION

While moderate inflation is generally considered normal in a growing economy, high or hyperinflation can have detrimental effects, such as eroding savings, distorting economic decision-making, and reducing the standard of living. Central banks and policymakers aim to maintain price stability by targeting a moderate and stable rate of inflation.

Read More Articles

Thanks for reading the article, if you have any questions or doubts please comment here – Thanks